Join 250+ More Successful CPAs, Accountants and Bookkeepers

6-WEEK ONLINE PROGRAM

Corporate Tax Accelerator

Learn how to prepare corporate tax returns and never turn away another client

Whether you're a bookkeeper or accountant, I’ll walk you through corporate tax returns using real examples, proven systems, and full support - so you can start saying yes to corporate clients.

Next Cohort: January 19, 2026 - March 6, 2026

Enroll Now

Core Learning

25+ hours of self-paced video lessons, SOPs, templates and other supporting materials

Exercises

Prepare 25 mock corporate tax returns. Follow video walkthroughs and gain hands-on experience with professional tax software.

Assignments

Prepare 5 mock corporate tax returns reviewed by a CPA or tax specialist. Get personalized feedback, revise your work, and sharpen your skills.

Live Webinars

Join 12 live webinars to reinforce learning and get answers in real time. All sessions are recorded for on-demand access.

Support Network

Private Group Chat and 1-year access to the Corporate Tax Support Network group, where alumni and I help each other navigate your first tax season, so you’re not going through it alone.

Professional Software

Receive a 6-week license to use professional tax software to complete all exercises and assignments, just like in a real tax practice.

About this 6-week online program

Overview

Most bookkeepers and accountants were never trained on how to file T2 corporate tax returns. Even though clients are asking for it, they hesitate and are worried about making a mistake or not knowing where to start.

Corporate Tax Accelerator is a 6-week online program that teaches you how to prepare and file corporate tax returns from start to finish. You’ll get access to video tutorials, exercises, CPA-reviewed assignments, weekly live webinars, and even professional tax software.

By the end of the program, you’ll know exactly how to file T2s, avoid costly mistakes, and start charging $1,000–$2,000 per return—without needing a CPA designation or firm experience.

What you'll learn

- How to file T2 corporate tax returns for Canadian Controlled Private Corporations ('CCPC') with active business income

-

How to handle common tax adjustments like Capital Cost Allowance ('CCA'), non-deductible reserves, vehicle expenses, etc.

- How to complete returns for CCPCs with investment income:

- Interest income

- Dividends (Canadian and foreign)

- Capital Gains

- Rental Income

- How to review the return and ensure it’s accurate and eligible for e-filing

- How to register for an EFILE number and stay compliant as a preparer

- How to guide clients through making tax payments to the CRA

Who this course is for

- Bookkeepers who want to offer corporate tax preparation.

- Accountants/CPA who want to open a tax firm but has no tax experience

- Accounting firm owners who want to train their new hires.

- In-house corporate accountants who want to handle T2 tax filings internally.

Requirements

- No prior tax knowledge required

- General understanding of financial statements or bookkeeping

- A laptop or desktop computer

- Around 2 hours a day to follow the program and complete assignments

Program at a Glance

Week 1: Build the Foundation

Week 2: Active Business Income

Week 3: Advanced Practice

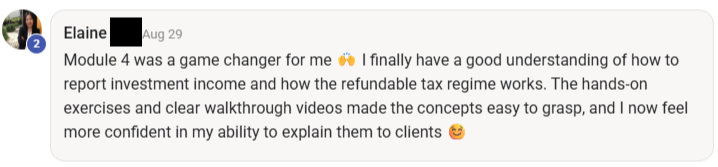

Week 4: Investment Income

Week 5: Advanced Practice

Week 6: Final Integration – Active + Investment

Take a Glimpse at the video Tutorials and Exercises

You’ll get full access to when you join

Day-by-Day Program Schedule

About your instructor

My name is Sam Cao. You might also know me as the Canadian Tax Enthusiast on social media, where I’ve built an audience of over 400,000.

I’m a Canadian CPA who spent years working at PwC before starting my own tax practice. Over the past few years, I’ve helped hundreds of clients file corporate tax returns and now teach others to do the same through clear, practical training.

I created this program because I kept meeting bookkeepers and accountants who were amazing at what they do but had never been trained to file T2 returns. Even though clients were asking for it, they had to say no or, worse, guess their way through it.

My goal is to make corporate tax preparation clear, simple, and profitable for you. Whether you're looking to offer T2 returns as a service or want to handle your own corporate filings confidently, this program will get you there step by step.

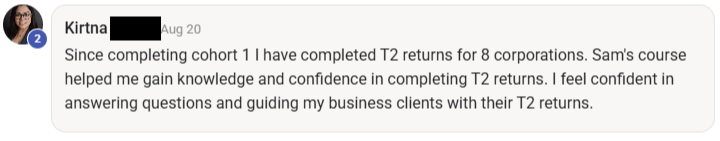

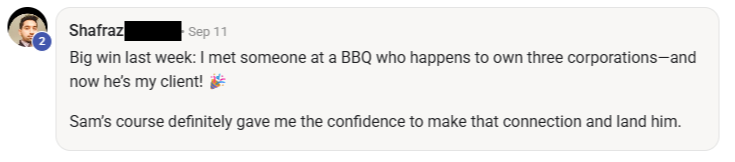

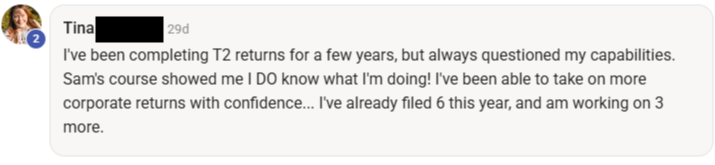

What past students have to say

Over 200+ CPAs, Accountants and Bookkeepers have joined the program

“It was incredibly refreshing to take part in a how-to bootcamp instead of another theory-heavy class. I operate a bookkeeping company with a team of five bookkeepers and around 50 clients. In the past, I’d forward tax returns to local firms, but they would often file late and charge exorbitant rates. Thanks to your videos, I was able to complete five returns over the past two and a half months—and I couldn’t be more grateful!”

- Evan van Dyk CPA CMA, Owner of Kermode Bookkeeping.

“Sam Cao's T2 Tax Bootcamp is a structured, practical, hands-on course focused on preparing Canadian T2 corporate tax returns. It provided me with the necessary information to confidently file T2's and will use this information to build on! Thanks Sam. ”

- Vijay Sharma, Owner of Modern Bookkeeping - Quantum Ledger

“I gained a lot of valuable information about T2 tax preparation and Canadian tax regulations through this bootcamp. The most important part was the daily tasks, which not only helped me learn the theory but also allowed me to practice my new knowledge and understand everything in detail. This hands-on approach made a huge difference in my learning experience!”

- Kateryna Yermakova, Owner of Balance Points Bookkeeping

“The Tax Bootcamp was an invaluable experience that provided clear, practical insights into complex corporate tax concepts. The course was well-structured, blending theory with real-world applications through case studies and interactive discussions. Sam is highly knowledgeable, making intricate tax rules easy to understand and apply. I now feel more confident in corporate tax compliance, and I highly recommend this bootcamp to anyone looking to enhance their expertise in this field."

- Stephanie Rojas, CPA, Founder of Suma CPA

“I have never filed a corporation tax return before, and now I feel extremely confident in myself to have the conversations with the clients and prepare T2 returns. This was an effective and great way to enhance my skills. Thank you Sam. "

- Oswald Erskine, Owner of Tax Connect

“Before attending this bootcamp, I had no experience filing T2 returns. The program provided clear, hands-on training that walked me through the entire process step by step. I learned not just how to complete T2s but also how to approach corporate tax filings with confidence. I highly recommend this bootcamp to anyone looking to develop practical tax skills for their practice. ”

- Patrick Inacio, CPA

Join the Corporate Tax Accelerator!

Cohort Starts January 19, 2026

For 6–12 Month Financing click here and select Klarna

For Group Pricing, please contact us at [email protected]

Frequently asked questions

Here are some common questions.